Project 4: Credit Risk Assessment

A project for finance industry or a hypothetical bank. Using machine learning models to predict whether a particular customer will default on their loan or not, based on different demographic indicators collected for the individual.

Project code:

Github Repository: credit-risk-assessment

Project Hosted on:

Importance:

- Banks want to reduce their credit risk. The recession in 2008 in the US happened because mortgage loans were given to people with bad credit scores resulting in a lot of people defaulting due to which a lot of banks and investors had to face huge financial losses.

Glossary:

- Credit Risk Modeling : Using data about a person to predict the probability of that person paying back the loan.

- Default risk : A person’s probability to not pay back their loan. Banks use this to calculate the interest rate for a person. They charge people interest rates that are proportional to their default risk.

About the Dataset:

Data Source: Credit Risk Dataset, Kaggle

| Column | Description | |

|---|---|---|

| loan_status | Loan status | 0 is non default 1 is default |

| person_age | Age | numerical |

| person_home_ownership | home ownership status | RENT, MORTGAGE, OWN, OTHER |

| person_emp_length | Employment length (in years) | numerical |

| loan_intent | Whether they own a home or not | PERSONAL, EDUCATION, MEDICAL, VENTURE, HOMEIMPROVEMENT, DEBTCONSOLIDATION |

| loan_grade | Loan grade | ‘D’, ‘B’, ‘C’, ‘A’, ‘E’, ‘F’, ‘G’ |

| loan_amnt | Loan amount | numerical |

| loan_int_rate | Interest rate | numerical |

| loan_percent_income | Loan to income ratio | numerical |

| cb_person_default_on_file | Historical default | ‘Y’, ‘N’ |

| cb_person_cred_hist_length | credit history length | numerical |

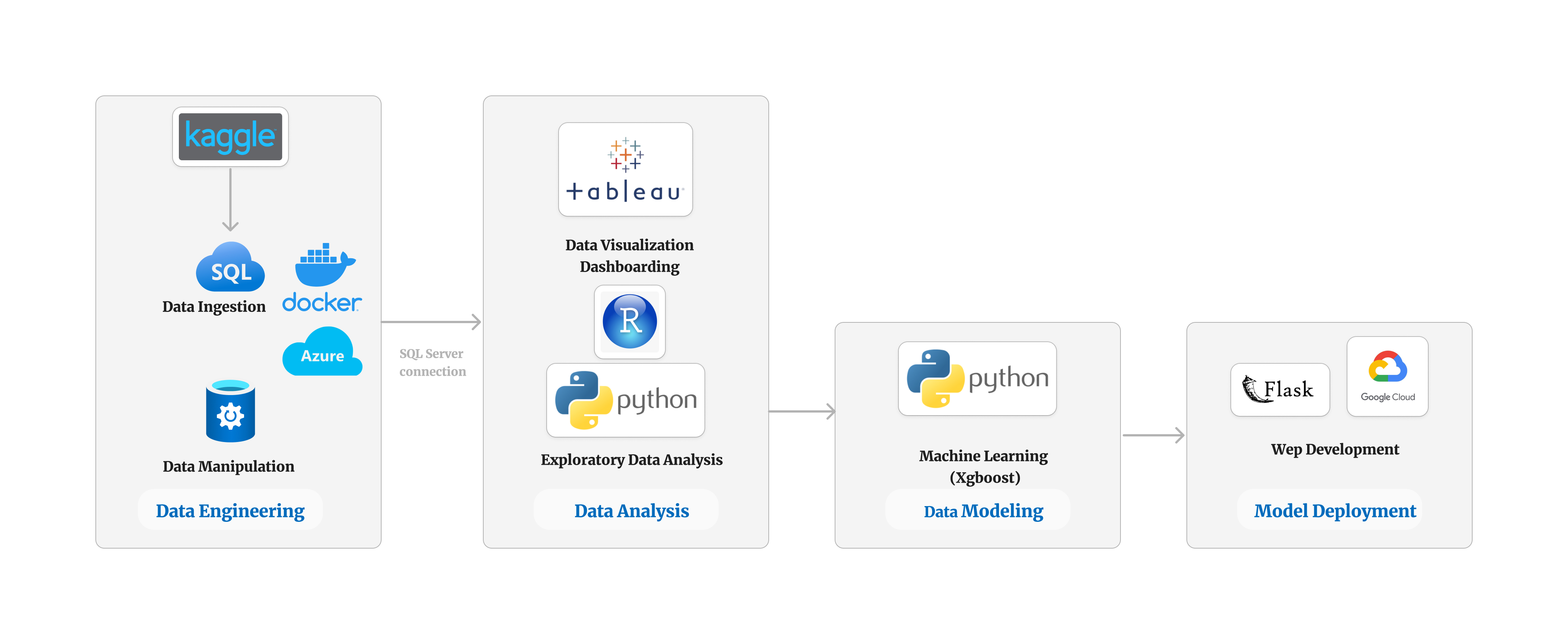

Models and Technologies:

-

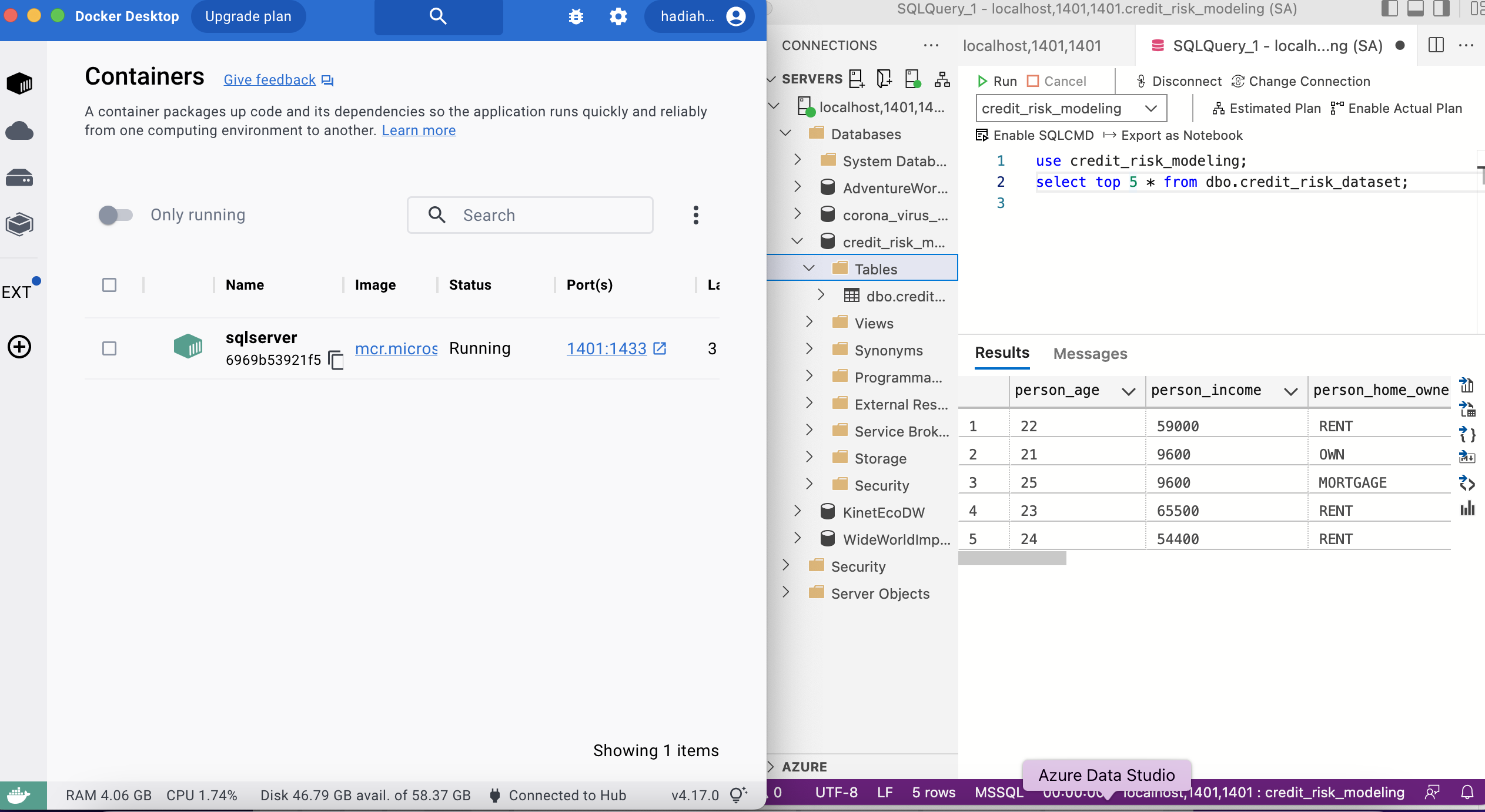

Azure Data Studio: Data in csv file loaded to SQL database created in Azure Data Studio. SQL server started on a Docker container.

-

Tableau: Connected to SQL database and built a dashboard for data visualization.

-

Python Jupyter Notebook: Built a machine learning pipeline using sklearn, pandas and XGboost to develop a classifier for predicting whether a person will default on their loan or not.

-

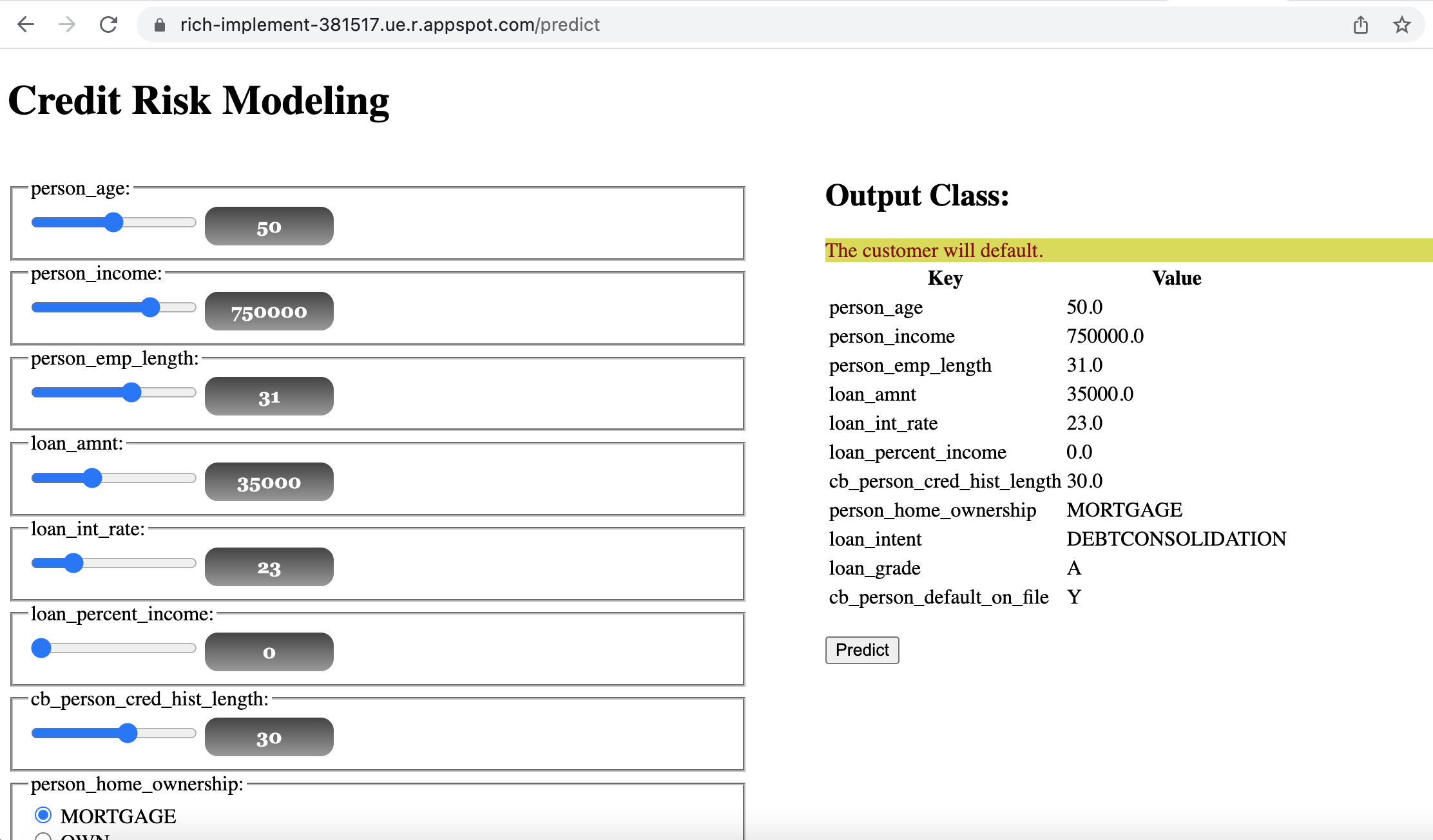

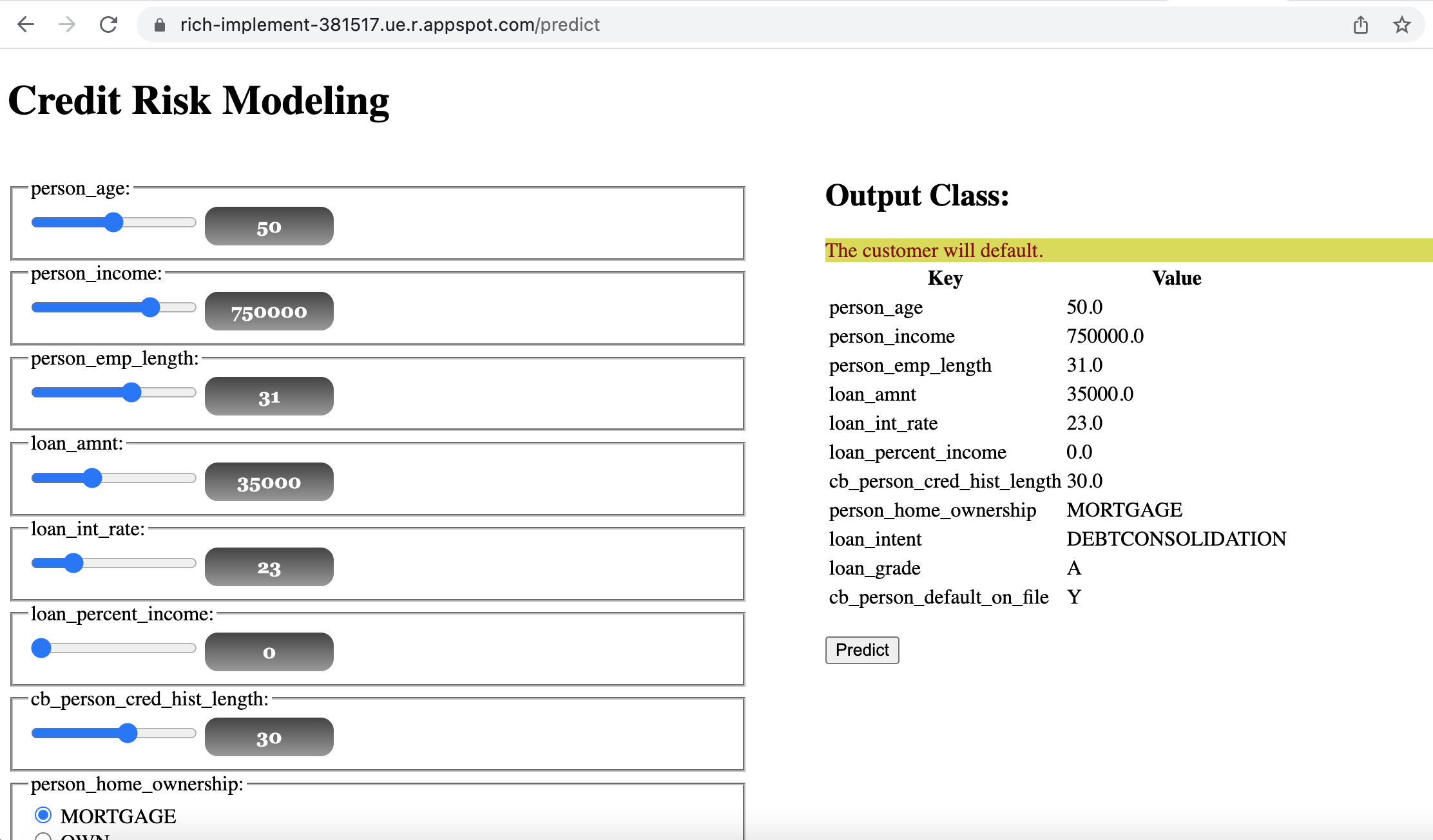

Flask Web application: Developed a python application using flask that takes certain inputs and used the already trained model in the backend to predict whether this new person will default on their loan or not.

-

Google Cloud Platform: Hosted the Flask app on GCP.

References:

[1] Credit Risk Modelling in Python by Rahul Sisodia

[2] Credit Risk Modelling in Python by Paul Bananzi

[3] How to Deploy Machine Learning Model using Flask (Iris Dataset) | Python by Aswin S.

[4] API Series #3 - How to Deploy Flask APIs to the Cloud (GCP) by James Briggs

[5] Azure Data Studio Essential Training by Adam Wilbert